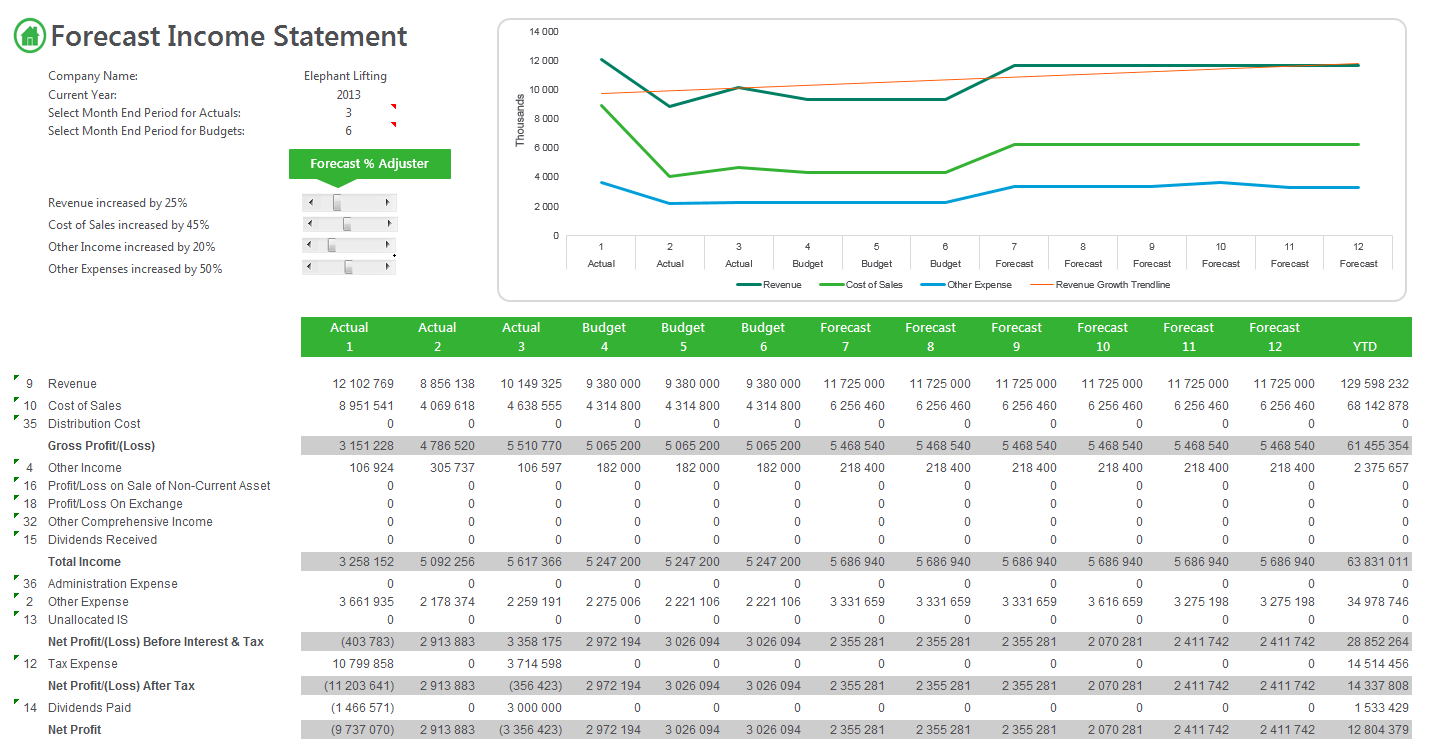

Either you can do this manually on a spreadsheet, in a cash flow template, or use a cloud-based software like Float to streamline the process. With your opening balance, you can then put in monthly forecasts for cash in and out based on when and how much customers pay, and when you expect to pay overheads and suppliers. Making sure these match is essential to the understanding of your finances. If you have unreconciled/ unmatched items in your accounting software then you’ll see discrepancies between your bank balance and your statement balance. This is why reconciliation is so important. Knowing that your opening balance is fixed is essential to having a stable starting point for your cash flow. If it impacts your bank balance, it’ll be on the cash flow. However, it won’t include things like depreciation expenses. Unlike the P&L budget, your cash flow forecast will show items such as tax, and repayment of loans and dividends.

BUDGET FORECAST DEFINITION HOW TO

Once you can see future peaks and troughs, you can play around with the numbers to work out how to maintain a positive bank balance, or reinvest any surplus cash in the business. It’s sensible to use a cash flow forecast to anticipate upcoming cash shortages and how to manage them. A forecast can’t show whether or not your business is profitable, but it will clearly show you what you’ll have in your bank at the end of the month.Ĭash flow forecasts are best used proactively rather than reactively. What is a cash flow forecast?Ī cash flow forecast is a plan of when cash will come into and out of your business. It’s also important to remember that your P&L budget does not include taxes, repayments of loans, or dividends. Using accounting software like Xero or QuickBooks can make this a lot easier.

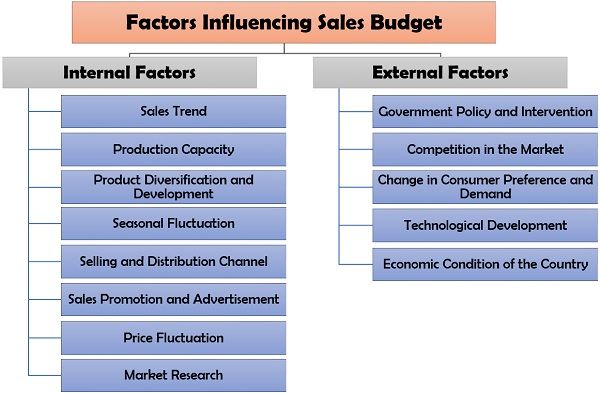

When mapping out your activities for your budget, use your chart of account categories so that you can compare/report on your budget vs actuals more easily. Depending on the size of your company, you might do a break-even analysis for multiple products or services. Making sure your outgoings don’t outweigh your incomings seems obvious but can be harder to stick to than you’d think. Knowing your break-even point is a good place to start. You’ll need to actively make strides to achieve your goals, and decide what resources you’ll need to achieve them. Having a business plan in place is only the first step. For this reason, it’s a good time to take a step back to analyse all the activities across your business. To make a P&L budget you’ll need to have a good understanding of the income you’re earning and the expenses you’re incurring.

In this way, it’s a good indicator of where you are and what you’re working towards. Profit and loss budgeting can work even if your figures are based solely on a best estimate of your expenditure and income. You might be asked for a P&L budget by a lender or investor, but keeping an internal one is always good practice. With this kind of accounting, it’s important to note that budgeting on a profit and loss basis means that your income and expenditure is accounted for when you incur them, rather than when the money is actually in the bank. In short, the P&L budget shows you how much profit or loss your business is planning to make, most often on a monthly basis. Your profit and loss is your business’s financial plan, comprised of your income and expenditures – including interest. Understanding the difference between your budget and forecasts can help you to properly plan for the future of your business. In order to make confident decisions, you need to know what lies ahead. Planning for the future is essential for business success.

0 kommentar(er)

0 kommentar(er)